PF Claim Status

Individuals with an EPF account are allowed to withdraw the accumulated funds during their employment under certain circumstances. However, tracking the EPF claim status process is imperative to make sure that the entire process is completed smoothly. EPF account holders should keep them up to date to know how much of the claim process has been forwarded.

To begin with, they should learn how to check the PF claim status and the associated requisites.

What is EPF Claim Status?

EPF claim status can be described as the latest information available about one’s application for EPF withdrawal.

It helps to gain a fair idea of their claim process’s development. Further, it enables applicants to readily prepare in case of an error or delay during the claim process. With the advancement in technology, the PF claim status can be checked in different hassle-free ways.

How to Check PF Claim Status?

Employees who intend to withdraw from their PF account and make a claim/or has already claimed for PF withdrawal can track the status of their PF claim online or offline. To elaborate, the following information highlights various ways one can utilise to check its development effectively.

How to Check PF Claim Status Online?

Following are the ways to check Online PF Claim status:

-

Through UAN Member Portal

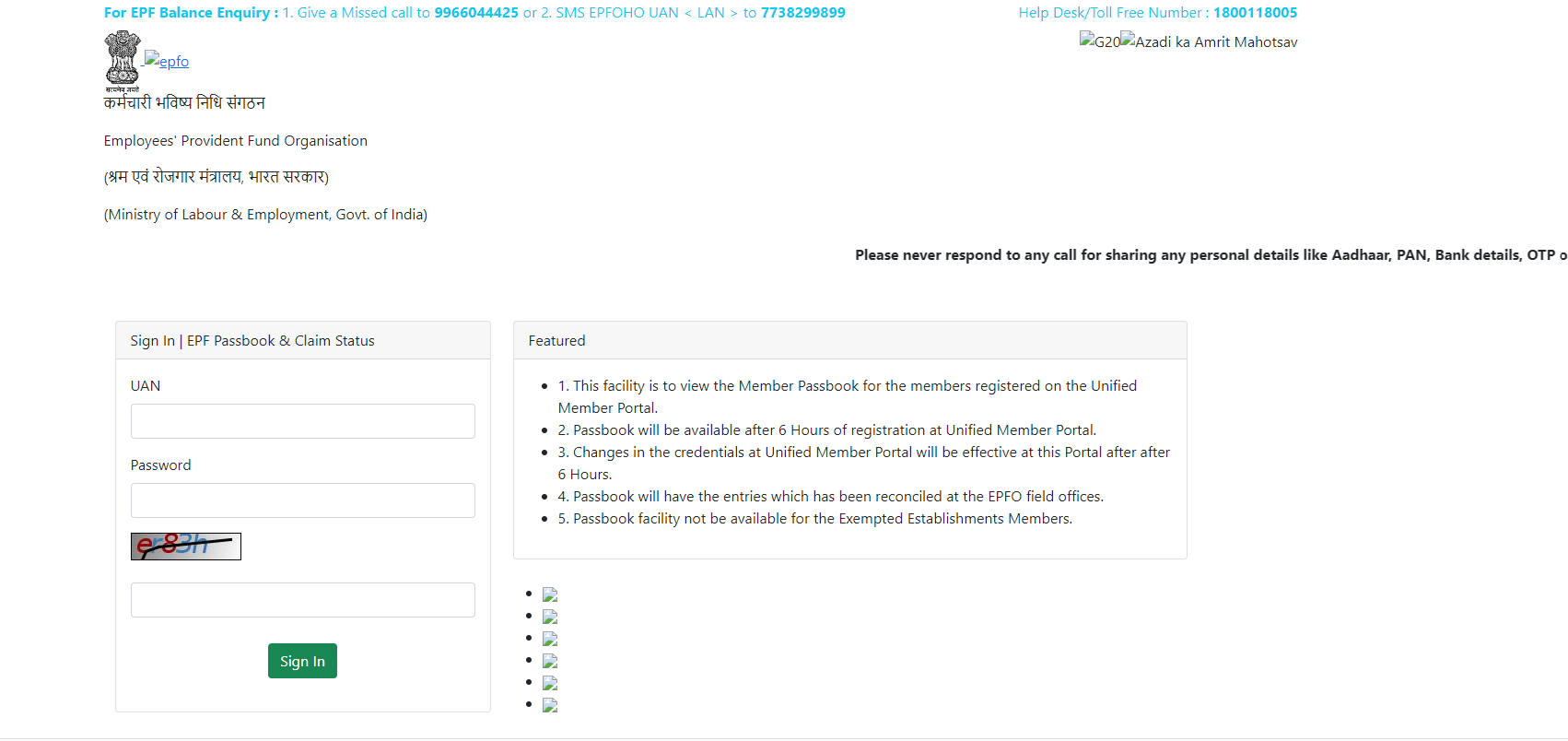

Employees can check the claim status of their PF on the UAN Member Portal by following these few simple steps.

Step 1 – Log in to your UAN Member Portal by entering your UAN and password.

Step 2 – Click on option ‘Online Services’.

Step 3 – Click on ‘Track Claim Status’.

Step 4 – The entire details of your withdrawal or transfer status will appear on the screen.

Notably, users who had opted for an offline claim process would not be able to track their claim status through this portal. Instead, offline applicants can track their status through EPFO’s official website.

-

Through the EPFO Portal

Individuals opting for this method to check EPF claim status online would have to proceed with the steps enumerated below.

Step 1 – To check online PF claim status via this route, visit EPFO’s dedicated portal.

Step 2 – Look for ‘Our Services’ option.

Step 3 – From available tabs, click on ‘For Employees’.

Step 4 – Once redirected to the next page, click on the ‘Service’ option.

Step 5 – Next, open the ‘Know your Claim Status’ option.

Step 6 – Enter UAN and CAPTCHA in the respective blocks.

Step 7 – Follow with clicking on the ‘Search’ option.

Step 8 – Next, select ‘Member ID’.

Step 9 – At last, click on ‘View Claim Status’ option to check the progress of your PF claim.

-

Using the PF Account Number Without UAN

Employees can also perform a PF claim status check online with the help of their PF account number in a few simple steps enumerated below.

Step 1 – Visit EPFO’s official website.

Step 2 – Navigate to the ‘Know your Claim Status’ page.

Step 3 – Open the ‘Click Here for Knowing the Claim Status’ option.

Step 4 – Next, select your respective PF Office State from the drop-down menu.

Step 5 – Select your city from the drop-down menu.

Step 6 – Next, enter your PF account number.

Step 7 – Click ‘Submit’.

On entering accurate details, the applicant’s PF claim status would appear on the screen immediately. Similarly, individuals who have updated their current mobile number with the UAN can check their claim status on the Umang App as well.

-

Claim Status via the Umang App

Step 1 – Look for EPFO option on the App’s home page.

Step 2 – Select ‘Employee Centric Services’ option.

Step 3 – Next, open the ‘Track Claim’ option.

Step 4 – Enter UAN and click on ‘Get OTP’.

Step 5 – Enter the OTP generated to verify and click on the ‘Login’ option.

By completing these steps, employees would avail details like – tracking ID, type of claim, the date on which the claim was raised and its status.

Most applicants tend to opt for the online PF claim status option as it is hassle-free and can be completed within a few minutes. Also, they do not need to furnish any documents to initiate the same.

Conversely, if applicants are not quite confident about the online methods, they may opt for alternate options that are available to them.

How to Check PF Claim Status Offline?

-

Through an SMS

Applicants can track whether their PF claim status is under process by sending an SMS from the mobile number that is linked with the UAN portal. They must pay attention to the SMS format before sending it to a required number to track their claim status accurately.

For instance, the latest SMS format is ‘EPFOHO UAN LAN’. Here ‘LAN’ stands for the language code in which users want to access their claim details.

The table below offers valuable insight into different languages and their codes.

|

EPFOHO UAN LAN(Language) |

LAN Code |

|

English |

ENG |

|

Hindi |

HIN |

|

Bengali |

BEN |

|

Tamil |

TAM |

|

Telugu |

TEL |

|

Marathi |

MAR |

|

Punjabi |

PUN |

|

Malayalam |

MAL |

|

Kannada |

KAN |

|

Gujarat |

GUJ |

-

Through a Missed Call

Employees can also check their claim status by giving a missed call from their registered mobile number on the toll-free number - 011-22901406.

Once the call is automatically disconnected, individuals will receive information about their PF claim status on their registered mobile number through an SMS.

Notably, applicants would be required to update their Aadhaar details, PAN and details of the bank account at the UAN portal.

Who Can Make EPF Claims?

Anybody with an EPF account would be deemed eligible to claim the accumulated funds under the following situations.

-

Post-retirement

Account holders who are over the age of 55 years can claim the entire EPF corpus. Conversely, those who have opted for early retirement would not be allowed to claim the entire value.

-

Prior to Retirement

Employees who are 54 years of age can claim up to 90% of their EPF corpus, provided they retire after one year.

-

In the case of Unemployment

Account-holders can claim up to 75% of their EPF corpus in the event of being unemployed for over a month. However, on starting a new job, they would be required to transfer 25% of the same to their EPF account. Individuals who have been unemployed for over 2 months are allowed to claim their entire EPF corpus.

Further, such partial withdrawal is allowed only in the case of funding required for higher education, medical emergency, or for constructing or purchase of a house property.

How to Initiate EPF Claim Process?

Before initiating the PF claim online or offline, applicants would be required to submit the respective claim form to the concerned authority.

To elaborate, factors like an applicant’s age, their status of employment and reason for withdrawal are taken into consideration to decide which form would be suitable for a given case.

The table below highlights the suitable claim form against each situation.

|

Form |

Case Suitability for PF Claim |

|

To transfer the accumulated fund into a new EPF account in the case of a job change. |

|

|

Form 14 |

To pay for one’s LIC policy. |

|

To claim advance/temporary withdrawal of EPF |

|

|

To claim pension fund when the account holder is less than 58 years of age and has to leave an establishment owing to physical disability. |

|

|

Form 20 |

A nominee can claim the PF of the deceased EPF member. |

|

To claim Scheme Certificate/Withdrawal Benefit as per Employees' Pension Scheme. |

How to Cancel EPF Claim?

It must be noted that once the claim status has been initiated, an option to cancel it online does not exist. Nonetheless, applicants may contact the EPFO-Regional Office as soon as possible to cancel their request for EPF withdrawal that was initiated online.