EPF Withdrawal Online

Employees’ Provident Fund or EPF is a compulsory savings scheme as per the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, initiated by the Government of India (GOI).

The primary aim of this scheme is to deliver a lump sum to salaried individuals to finance their post-retirement funding needs.

Individuals can take advantage of the EPF Withdrawal Online process with easy steps.

How to Apply for EPF Withdrawal Online?

Individuals can benefit from the convenience of the withdrawal process of PF online.

Employees should, however, ensure that their contact number used to activate UAN is operational. Besides, KYC verification and linking of the bank account via IFSC code should also be completed for each UAN for the application to proceed.

To learn how to withdraw PF, remember there are 3 ways you can initiate the PF withdrawal process, viz.

- Submission of an Online Application

- EPF withdrawal through App

- By Submitting a Physical Application (PF withdrawal offline)

1) Online Application Submission

EPFO has lately introduced the online facility of withdrawal, which, in turn, has made the entire process hassle-free. However, there are a few prerequisites that should be met before applying for the withdrawal of EPF online through the EPF portal:

- The Universal Account Number (UAN) must be activated, and the mobile number used for activating the UAN should be in working condition.

- The UAN must be linked with the member’s KYC, such as the Aadhaar card, PAN and bank details with the IFSC code.

To understand how to withdraw PF amount online, follow the steps below-

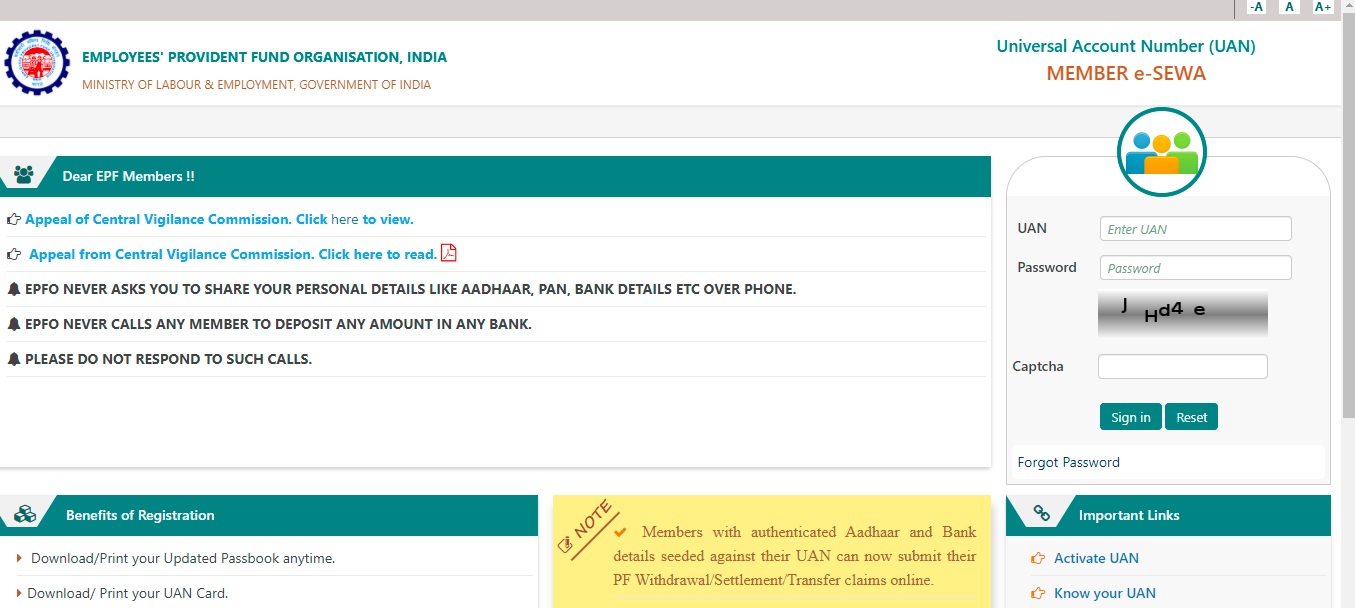

Step 1: Visit the official portal of EPFO.

Step 2: Use UAN and password to login into the EPF account. Enter the captcha to authenticate the login.

Step 3: Select the ‘Manage’ tab to access available options.

Step 4: Choose ‘KYC’ to determine whether the details provided via the KYC documents are authentic and accurate.

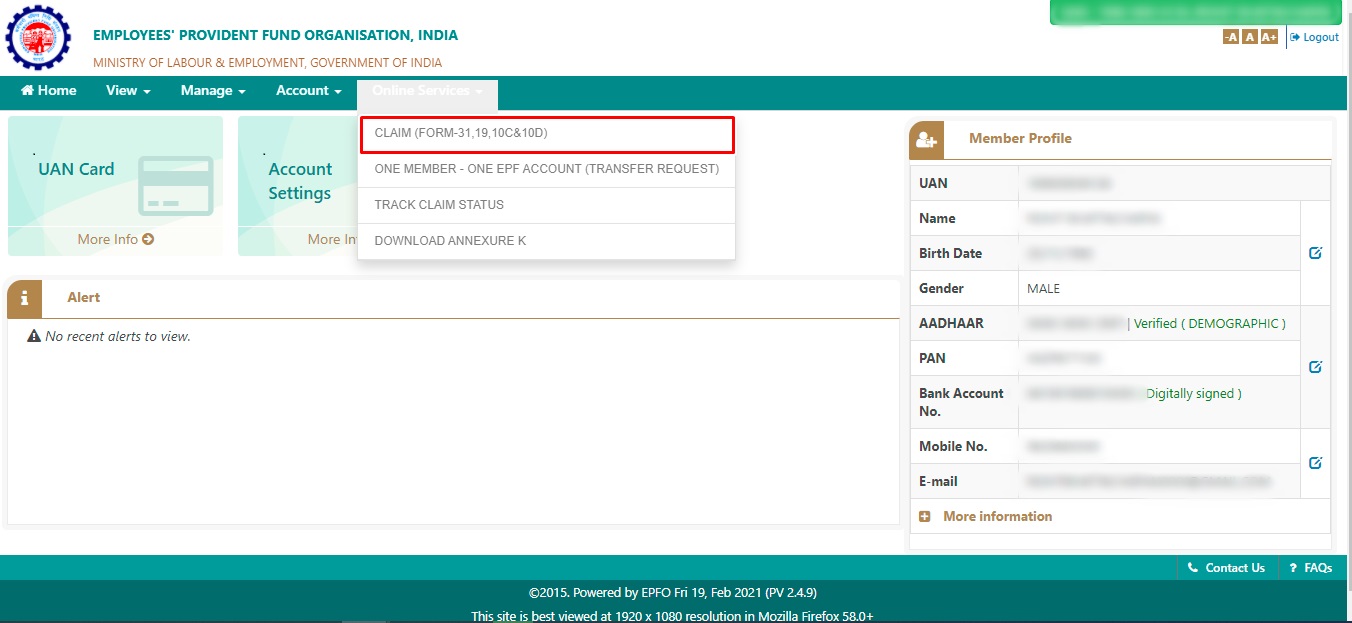

Step 5: Select the ‘Online Services’ tab.

Step 6: Choose ‘Claim (Form 31, 19 & 10C)’.

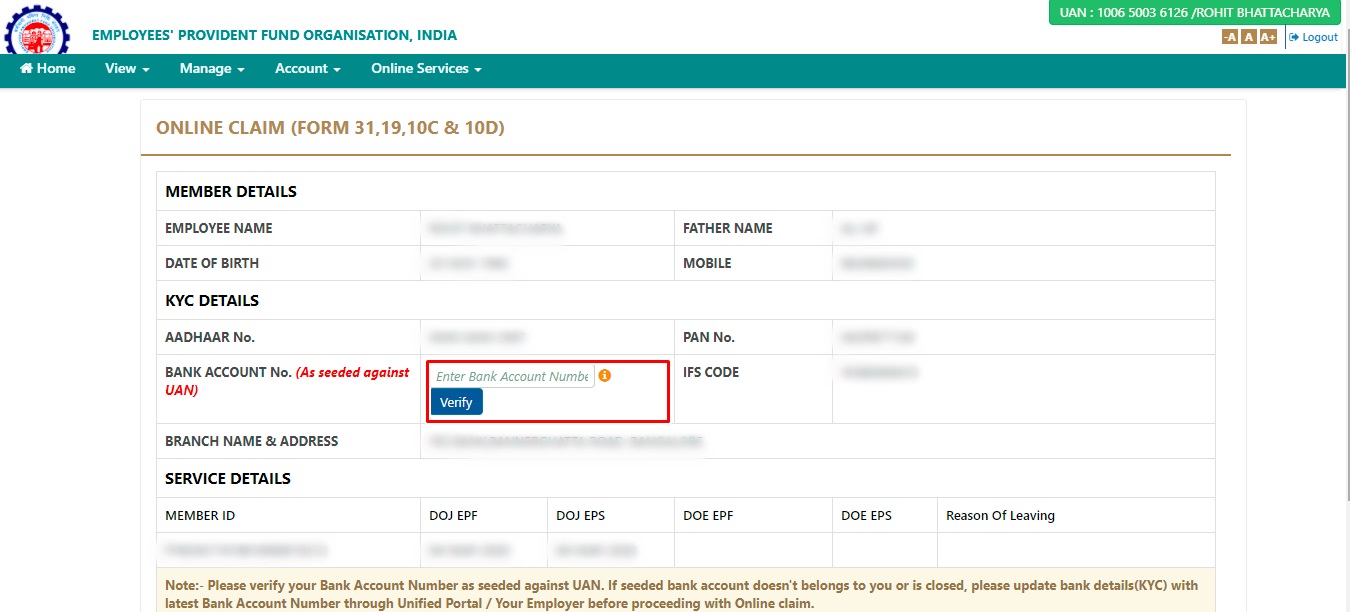

Step 7: Verify the details displayed on the current page. These include KYC information and additional service details.

Step 8: Input the last four digits of the registered bank account and click on ‘Verify’.

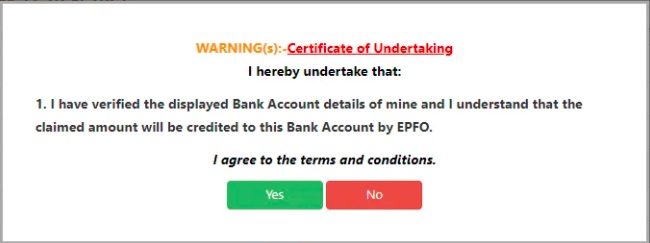

Step 9: Select ‘Yes’ for your online certificate of undertaking, stating that the EPF claim amount will be credited to the bank account mentioned.

Step 10: Click on ‘Proceed for Online Claim’.

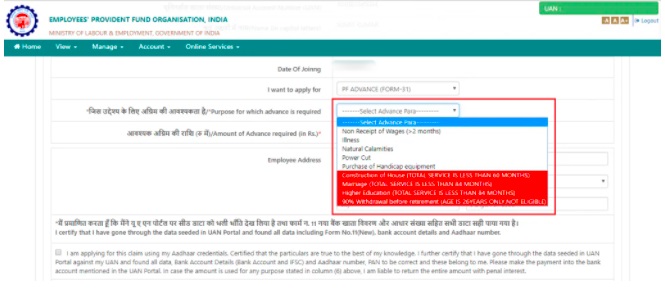

Step 11: Under the ‘I Want to Apply For’ option, select Full EPF Settlement, EPF Part Withdrawal, or Pension Withdrawal, as required.

Step 12: Choose the correct purpose under the ‘Purpose for which advance is required’ option.

Step 13: Enter the amount of advance required.

Step 14: Upload scanned documents required for approval. The employer is also required to approve this request for withdrawal to be complete.

Step 15: The EPF withdrawal amount is expected to be credited to an applicant’s bank account within 15-20 days from the date of application.

2) EPF Withdrawal through App

Employees availing of the online withdrawal route also have the option to use Unified Mobile APP for New Governance (UMANG) for a convenient withdrawal process on their mobile phones.

The simplified online application process, along with services offered by UMANG, are meant to make the online process of EPF withdrawal an easily accessible option for individuals who require additional funds to finance specific requirements recognised by the EPFO.

Individuals can, however, file for an EPF withdrawal offline by printing out a composite claim form and providing the following details. Also, self-attested documents, along with the employer’s approval attestation, need to be submitted to the regional EPFO commissioner.

3) Withdrawal by Submitting a Physical Application

One can download the new composite claim (Aadhaar)/composite claim form (Non-Aadhaar) by visiting the official EPFO portal.

This new composite claim form (Aadhaar) can be duly filled and submitted to the respective jurisdictional EPFO office without the attestation of the employer, whereas the new composite claim form (Non-Aadhaar) shall be filled and submitted with the attestation of the employer to the respective jurisdictional EPFO office.

Keep in mind that in case of partial withdrawal of EPF amount by an employee for any emergency, very recently, the requirement to furnish various certificates has been removed, and the self-certification option has been introduced for the EPF subscribers.

Complete EPF Withdrawal

EPF can be withdrawn completely in the following circumstances-

- When a person retires.

- When a person is unemployed for more than two months, in this case, an attestation from a gazetted office is required in order to withdraw the EPF amount.

- One cannot withdraw their entire EPF balance if they have not been unemployed for two months or more (i.e. the interim period between changing jobs).

Partial EPF Withdrawal

Partial withdrawal of EPF is only permitted during an emergency such as a medical emergency, house purchase or construction, marriage and higher education. EPF withdrawal limit, in this case, depends on the withdrawal reason.

The account holder can request a partial withdrawal through online mode.

EPF Withdrawal Eligibility Criteria

Individuals are required to fulfil a handful of eligibility criteria to avail of part withdrawal and final settlement on their EPF account.

The table mentioned below specifies the conditions for the withdrawal of specific amounts from EPF accounts along with their corresponding forms to be submitted to avail of this facility.

|

Eligible Conditions |

Forms Required |

|

|

|

Form 14 |

|

|

|

Form 20 |

|

Form 5IF |

Additionally, individuals who have been unemployed for 2 months can claim 75% of their deposits in the form of non-refundable advances using Form 31, only on the condition that their unemployment is certified by a gazetted officer of the Government of India.

Employees who have subscribed to the Voluntary Retirement Scheme (VR) at 55 years of age are eligible for EPF withdrawal online as a full and final settlement by submitting Form 19.

Documents Required for EPF Withdrawal Online

Under the EPF Withdrawal rules - you will have to hold certain documents.

EPFO stipulates that individuals should possess the following vital documents before applying for EPF withdrawal-

- 2 revenue stamps

- A valid bank account statement

- Aadhaar Card

- PAN Card

- Voter ID Card

- Cancelled blank cheque

The Bank account number and IFSC code of an individual should be visible on the cancelled check for the successful approval of the withdrawal application.

Tax Liabilities on the Withdraw EPF Amount

The amount withdrawn from an employee’s EPF account is liable for a percentage of tax deduction depending upon the tenure of service of such employee with an employer during the time of such withdrawal.

In case an individual is availing withdrawal facilities without completing 5 years of employment with a particular organisation, he/she has to pay a Tax Deducted at Source (TDS) of 10% if PAN is furnished during the PF withdrawal process.

In the absence of PAN, the individual is liable to a TDS of 34.6% on the amount withdrawn. Individuals with less than Rs. 50,000 in their EPF accounts at the time of withdrawal are exempted from TDS liabilities.

Since the withdrawn amount from an EPF account is perceived as income, employees availing of such facilities have to mention it by selecting ‘Section 10(12) Recognised Provident Fund’ while filing ITR.

Online EPF Withdrawal is, therefore, an easy process that simplifies the claims procedure availed by employees. Online withdrawal also contributes to the lesser time required for the claim amount to be transferred to an employee’s bank account.

Besides the time-saving factor, an individual can also bypass the attestation requirements of employers by using the online method of withdrawal, which makes it a popular mode of EPF withdrawal.

EPF Withdrawal Forms

Here are the different forms for EPF withdrawal and their purposes.

|

Forms |

Purpose |

|

For the final settlement of EPF. Applicants who have retired or are unemployed for 2 months or more can apply with this form. |

|

|

For partial withdrawal of EPF. This is only allowed if an applicant has retired or is unemployed for 2 months or more. |

|

|

For EPS (Employee Pension Scheme) withdrawal while retaining membership with the pension fund. |